It Makes Cents

To Compare

Your Home Loan

It Makes Cents

To Compare Your

Home Loan

Compare from 40+ lenders to get competitive home loans and interest rates within minutes

We do all

the hard work

Obligation &

Cost Free

POWER TO NEGOTIATE

Expert Advice

Lifetime Support

What our customers are saying

Use our helpful calculators to crunch the numbers

Home Loan Comparison Calculator

Home Loan Repayments Calculator

Stamp Duty Calculator

How to compare home loans and rates

IT IS SIMPLE TO GET STARTED:

Frequently Asked Questions

What’s new for home loans in 2025?

The Australian home loan landscape continues to evolve in response to shifting economic conditions, policy changes, and consumer expectations. After years of turbulence following the Covid-19 pandemic and the rapid rise in interest rates through 2022–2023, 2024 was marked by record-high borrowing costs and tighter household budgets. Entering 2025, the market is showing early signs of stabilisation, though affordability remains front of mind for many Australians.While interest rates remain elevated compared to the ultra-low fixed rates of 2020–2021, the pace of increases has slowed. Many lenders are cautiously adjusting their offerings, with a stronger focus on variable rate competitiveness and refinancing options. Borrowers who rolled off low fixed-rate terms are now seeking strategies to manage higher repayments, making mortgage brokers and financial advice more valuable than ever.2025 has continued the shift towards tailored lending solutions. Banks and non-bank lenders are using smarter digital tools and open banking data to better assess borrower profiles, offering more personalised loan structures. Digital application processes have become faster, with same-day pre-approvals increasingly common, streamlining what was once a drawn-out experience.The home loan market in 2025 is navigating the balance between economic caution and innovation. With affordability pressures, government housing initiatives, and technology-driven solutions shaping the landscape, borrowers are better supported with tools, advice, and product options to match their financial circumstances. We stand in that junction ready to assist you in any way we can!

What is a home loan?

Taking out a home loan is when you borrow a percentage of money from a bank or lender to buy a house, this is typically (but not always) no less than 95% of the value of the house. The bank or lender lends this money in exchange for paying interest on this money. The bank or lender uses the house as a ‘security bond’ to ensure you will pay back the loan in full over a defined time period at an agreed interest rate (be it fixed or variable). This means you agree for the lender to repossess the house should you default on paying back the loan. The lender typically gives you twenty to thirty years to repay the loan, This benefits both parties, in that the borrower can then afford to repay the loan sustainably over time. It also benefits the lender because the length of time to repay the loan maximises the amount of interest the lender makes and mitigates the security risk they hold on the house, as property typically accumulates capital growth over time. Thats is why its is vital that you compare home loans and rates to find the best fit.

What is an interest rate?

The interest you pay on a home loan is in essence the price you pay to buy the money you need to purchase the home. Banks and lenders, when they offer interest rates are essentially ‘selling money’ to people wanting to buy a home but do not have the full purchase amount. It's important to compare home loans to make sure you're on the best rate!

How much can I borrow?

Banks and lending companies need to assess your borrowing power before you can buy home loan products. They need to know if you can pay a deposit to secure the property and if you can pay for your loan.

Banks calculate your serviceability to decide how much you can borrow in a home loan. Mortgage serviceability refers to the borrower’s ability to meet home loan repayments. Through serviceability calculations, banks can determine if you can afford your mortgage, as well as the maximum amount you can borrow. Read More…

Can I refinance?

If you got a loan that’s too risky or pricey, you usually could refinance and turn it into a better loan. However, you should still be extra cautious and take into consideration all options before you proceed in refinancing your mortgage. It is a good idea to refinance when Read More…

How do I choose the best home loan?

It is vital that you compare home loans and rates to find the best home loan. MakesCents currently compares over 40 lenders easily and all in one place. You can get started in less than 60 seconds. It’s completely free, obligation free and will not affect your credit rating. How much will my repayments be?

A mortgage repayment calculator gives you an estimate of your repayments, whether monthly, weekly, or fortnightly. You can change your payment terms, so you can assess which term is much suited for you. Read More…

How do I apply for a mortgage?

Applying for a home loan is a careful and detail-oriented process. You cannot simply choose the first home loan product that you see on the Internet. You will have to do ample research to find the home loan product that suits your budget and needs. Comparison sites, such as Makes Cents, help borrowers make an informed decision in choosing a home loan provider. Read More…

How do I access the best and cheapest rates?

Here are 7 Ways to Save Big on Your Mortgage, Read More…

Do I go variable or fixed interest?

Variable home loans have variable interest rates. These can change at any time, whether increasing or decreasing. Because of its changing nature, variable home loans tend to offer more flexibility and lower rates upfront.

On the other hand, fixed home loans have fixed interest rates. The interest rates stay fixed at a constant rate for a set period, which is usually 1 to 5 years. As the rates cannot increase or decrease, this type of mortgage typically offers less flexibility. After the set or fixed period is over, the home loan becomes a variable rate.

Read More…

What is LVR?

The mortgage registration fee is one of the costs incurred when purchasing a new property or refinancing a home loan. Although it’s just a minor expense, it’s vital to factor this in when refinancing. Read More…

Can I get a home loan if I have a bad credit history?

If you have bad credit, you’ll find that getting a home loan is much tougher. If you’re looking to have your home loan approved, this guide will help direct you in finding the right loan and how to approach it. Read More…

How does the home loan application process work?

the home loan application process is a complicated one and can vary from lender to lender. With so many steps involved, it is easy to get lost and confused. It is normal to feel overwhelmed and not know where to start your application.

If you are one of the many hopeful homebuyers who simply want to have a place to call their own, then you have come to the right place. Here are the stages and steps that make up the home loan application process.

Read More…

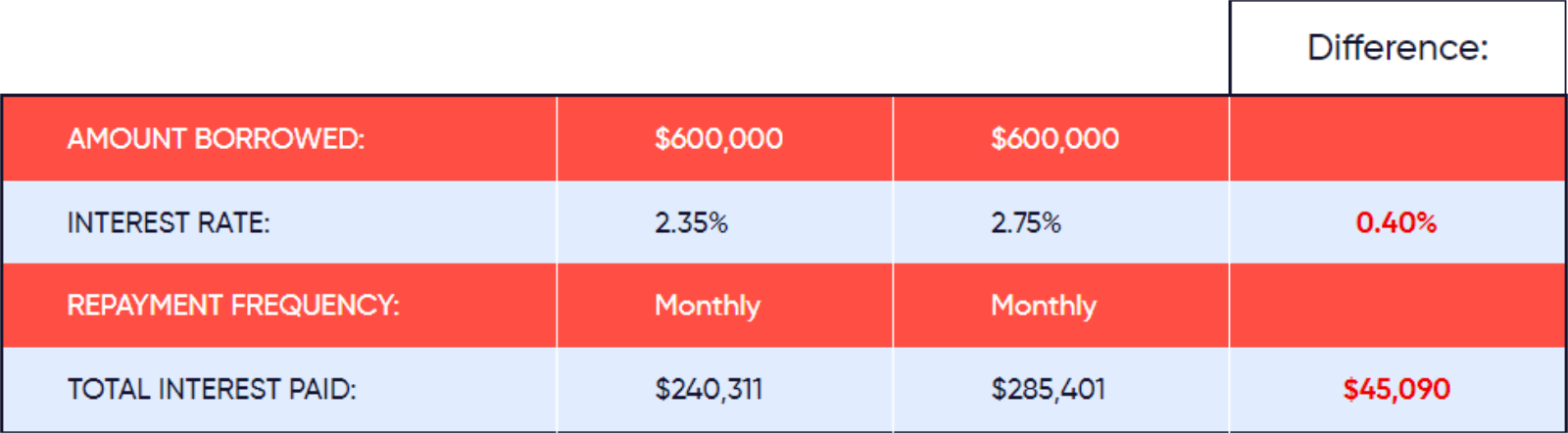

Should I just go for the lowest interest rate?

When you are comparing home loans or considering refinancing, the interest rate is obviously an important and significant factor, however, there are a number of other features and factors that can also impact on the total cost of the loan.

FOR EXAMPLE:

- Any fees payable on the loan

- Offset account features and limitations

- Redraw facilities, fees and penalties attached to this.

- Ease of working with that lender (ie: do they have an app? Is it easy to make repayments?)

The smallest difference in maximising these factors and features, can mean the difference in tens of thousands of dollars, given the loan is a large amount spread over a long period of time. Similarly, getting this right can also allow you to pay your home off sooner than you first thought.

A good mortgage broker can talk you though all of these technical things to make sure you get the best rate combined with the best features.

How to compare Home Loans and Interest Rates?

It's important to remember that when comparing home loans and interest rates, they can have only small variances, but depending upon the size of the loan and the length of the loan, it can make a big difference. Example: On a $600,000 loan amount, if you refinance to only a 0.40% cheaper interest rate, you will save a whopping $45,090 over the life of the loan. That is $1,503 per year or $125.25 a month over the life of a 30 year home loan.

Why should I use a mortgage broker to help me compare and apply for home loans or refinancing?

Benefit of using a Mortgage Broker No. 1: The convenience factor

First and foremost, the benefit is in the ‘ease and access of choice’. Using a mortgage broker can allow the borrower to access rates and products from multiple lenders in the market, giving you choice and a true comparison. Without the services of a mortgage broker, the burden of research essentially falls on you.

According to multiple studies, unfortunately even today, nearly 70% of Australian’s do no use a mortgage broker. That means 70% of Aussies are either just “trusting their bank has the best product and rate” or are attempting to shop around themselves, directly with lenders. This can be both tiresome and confusing, given that there are now around 50+ bank and non-bank lenders in Australia. Could you imagine enquiring directly with 50 lenders?

Benefit of using a Mortgage Broker No. 2: One point of data entry

If you choose to ‘go it alone’ you will need to fill out pre-qualification documents with each individual lender, each time you apply. This can be a tiresome exercise when done once, let alone half a dozen times or 50 times if you want to find the best rate yourself without a mortgage broker.

Using a mortgage Broker allows you to do ONE(1) pre-qualification application, that is then typically entered into their aggregator software. Once they have lodged this, the system links with multiple lenders (often 20 – 50 lenders, depending upon who they are accredited to work with) and delivered the best possible rates and loans available from these lenders. You then can sit down with your mortgage broker and determine the best home loan for you.

Benefit of using a Mortgage Broker No. 3: No extra cost

Many Australians do not realise that the services of a mortgage broker is typically (unless pre-stated) FREE of charge. The mortgage broker does not need to charge you a fee because they are remunerated in commissions by the lender they write the loan for.

For example, if you apply for a home loan with a mortgage broker and compare 20 home loans and choose Suncorp Bank to go with, Suncorp Bank will pay the mortgage broker a commission for bringing the business to Suncorp Bank. Many people believe that they need to pay a fee to the mortgage broker or perhaps they can get it cheaper if they go directly with the bank, but in most cases this is false. Another reason you may not be able to get a cheaper rate from the lenders directly is that mortgage brokers also provide a valuable service to the lender because the mortgage broker is handling all the documentation and dealing with the clients directly.

Benefit of using a Mortgage Broker No. 4: Independent Advice

If you bank with a particular bank or lender and then approach them for a home loan, typically they are only offering you ‘their best rate’ that they have for you, not the markets best rate. Similarly, if you already have a mortgage with a bank or lender, we can guarantee you that they are not calling you and telling you that another bank has a better rate than them, even if it would be in your best interest to know this.

Periodically sitting down with a mortgage broker can prove to save you thousands of dollars in the long run, purely because you get a ‘whole market’ view of what is available and best for you.

We’ve seen sometimes up to a 3% variance in people’s home loan rates before we refinance them. For example Sarah was on a 3.65% rate before we found her a 1.95% refinance rate saving her thousands per annum and potentially years off her mortgage. Her bank’s best rate for her was 3.65%, but this was not the markets best rate for her. Without talking to a mortgage broker, she would be overpaying thousands of dollars in interest over the life of the loan.

Why choose us as your mortgage broker?

Get the right product for your situation

We carefully assess your long-term goals and financial situation to make sure that you get the home loan or refinance solution that suits your needs.

Get the best interest rates. (for you)

We offer the benefit of choice! Over 35 lenders and thousands of their products are compared when looking at your goals and requirements. We have nurtured our relationships with our panel of lenders throughout the years of working with them. This allows us to access the best interest rate based on your application. We want to chat to you and find out more about you and your goals and desires, because the “best loan” might not always the “best fit”. Our value advantage is not just “rates” but solutions to suit your goals and dreams.

Easy application, fast approval

The pre-approval and application process in purchasing a house is often complex. We’ll help you navigate through it so that you can purchase your home without a fuss. We can also make your dream of owning a home so much faster. We also offer lightning fast refinance settlements for our clients.

We are an independent broking company

We are not owned by a bank, and we are under no obligation to offer you their products. We are completely privately owned with no outside investment, ulterior motive or interest. Our mortgage brokers are actually paid a salary, their commissions are equal across lenders and therefore less incentivised to “sell” you anything, as much as they are obligated to offer you the best product to suit your needs and goals. Our brokers will provide you with sound and carefully considered home loan and finance advice.

Access to over 40 lenders

We have access to more than 40 major lenders, banks, credit unions and other specialised lenders that offer competitive rates and flexible credit policies. Our platform allows us to quickly scan thousands of loan products from their lenders and present you with the most suitable lender and products.

Count on our nationwide services

Our technology capabilities and broker locations can help you find the most suitable home loan (and help you qualify for it) no matter where you are in Australia. It doesn’t matter if you live in Victoria and are buying an investment Property in New South Wales or Queensland, we can help you no matter the geography.

We offer exceptional post-settlemment service

Maybe you’ve been left out to dry by your existing bank? Treated like just another number in the system? If you think that we’ll leave you after buying your home own, think again. We’ll be there to assist you throughout the duration of your home loan. Moreover, we will be available to answer your post-settlement questions and help you make amendments, additions and changes to your loan. Post settlement of your home purchase or refinance, we will be with you and in contact with you even if a more suitable or better product comes up and we think it might be better suited to you. The market changes, rates change and so do your circumstances. We will monitor this and make sure you are always ahead of the curve.

Honest valuations and credit reports

We will not lead you on. Instead, we will give you an upfront estimate of how much you can borrow from the bank. We will also guide you through the application process so that you can secure a home loan approval and not charge you for it. You can access free home value reports and credit reports from us, for life. Want to buy an investment property? We can offer some free reports and valuations to help you make an informed decision.

We’ll take you to lenders who can help

Unlike most mortgage brokers, we are not just after your money or just a fast transaction. We know which lenders can help, so we will not be wasting your time by sending you to lenders who can’t.

We know the policies of each of the lenders we deal with, as well as potential problems and hidden catches that you might encounter. Our extensive pre-application credit assessment process ensures that we have screened the bank or lender’s application process and qualifications thoroughly before applying with them.

Most of our mortgage brokers have worked in major lenders before. As a result, they know the ins and outs of approving and declining loan applications and understand how to get your home loan approved.

Need a more bespoke solution? We also specialise in all types of non-conventional home loans, including low doc loans, non-resident home loans and unusual employment loans.

We have your best interests at heart

You’ll be glad to know that under Best Interest Duty, we have a legal obligation to act in your best interests. On the other hand, banks and other lending institutions are not legally required to do so. This means you can have peace of mind knowing that Makes Cents will not hang you out to dry.

Compare Home Loans and Rates From

40+ Lenders Now

Compare Home Loans

and Rates From

40+ Lenders Now

COMPARE NOWMakesCents is here to help

We are always here to support you anytime you need

Give us a call

Book an appointment

Find your local MakesCents Broker